AI in Finance & Insurance — Industry Use Cases

From fraud detection to credit scoring — ETHORITY powers ethical AI that remains fair, explainable, and compliant.

By 2030, 90% of financial institutions will run AI-driven risk and compliance models (EBA foresight). Fraud detection, algorithmic credit scoring, and customer analytics will form the backbone of financial services. But with opportunity comes scrutiny: regulators classify these systems as high-risk AI under the EU AI Act.

ETHORITY pioneers Trust-by-Design finance AI, embedding continuous monitoring, fairness testing, and Assure Certification. We ensure financial AI doesn’t just predict risk — it proves compliance, fairness, and resilience.

Why AI in Finance & Insurance Matters

Systemic Pressures

Global fraud losses projected to exceed USD 50 billion annually by 2030 (PwC foresight).

Algorithmic credit scoring already drives over 70% of loan approvals, forecast to reach near-universal use by 2030.

The EU AI Act mandates transparency, fairness, and human oversight in financial AI systems.

Strategic Opportunities

Real-time fraud detection reduces losses and enhances trust.

Bias-tested credit scoring improves financial inclusion and reduces reputational risk.

Visible Assure Certification trust marks create competitive advantage — proof of governance and compliance.

Research & References

1. Global Frameworks & Industry Outlook

PwC Global AI in Financial Services Outlook

PwC’s global study forecasts exponential growth in AI adoption across the financial services sector, with a focus on automation, fraud prevention, customer analytics, and ethical governance. By 2030, AI is projected to contribute over USD 1 trillion in annual productivity gains to the global financial system.European Commission – EU AI Act

The EU AI Act establishes risk-based governance for financial AI systems, classifying credit scoring, algorithmic trading, and automated risk assessment as high-risk use cases. It requires strict transparency, fairness, and documentation obligations for financial institutions.MIT CSAIL Research on Adversarial Attacks

MIT CSAIL researchers uncover vulnerabilities in AI models used for fraud detection and trading, showing how adversarial perturbations can mislead classifiers. Their work emphasizes the need for robust model validation, anomaly detection, and defense strategies in financial AI.OECD AI Principles – Finance

The OECD AI Principles form the global ethical foundation for AI in finance, promoting fairness, transparency, and accountability. Financial institutions that adopt these principles improve consumer trust and reduce systemic risk by aligning their governance better.McKinsey – Future of Risk Management

McKinsey highlights how AI transforms risk management by enabling predictive compliance, real-time monitoring, and scenario-based resilience testing. The report underscores the importance of cross-functional governance and AI literacy at the board level.

Analysis: AI Use Cases & Compliance

Key Use Cases

EthiScope™ Monitoring → bias detection, drift monitoring, adversarial guardrail testing.

Assure Certification → Bronze (compliance baseline), Silver (continuous monitoring), Gold (full governance integration).

AI Credit Scoring → transparent, explainable, audit-ready decision models.

Fraud Detection → anomaly detection with fairness controls and resilience checks.

Risk Dashboards → real-time oversight for boards and regulators.

Compliance Landscape

EU AI Act → finance AI = high-risk category.

GDPR & PSD2 → strict consent and data protection requirements.

OECD & IOSCO → fairness, accountability, consumer protection.

Challenges

Bias and drift in credit models.

Lack of explainability in black-box decision systems.

Rising adversarial attacks on financial AI.

Integration: ETHORITY’s Role

ETHORITY delivers trusted financial AI ecosystems:

Platforms → EthiScope™, Assure Certification.

Governance-by-Design → evidence kits, dashboards, audit trails.

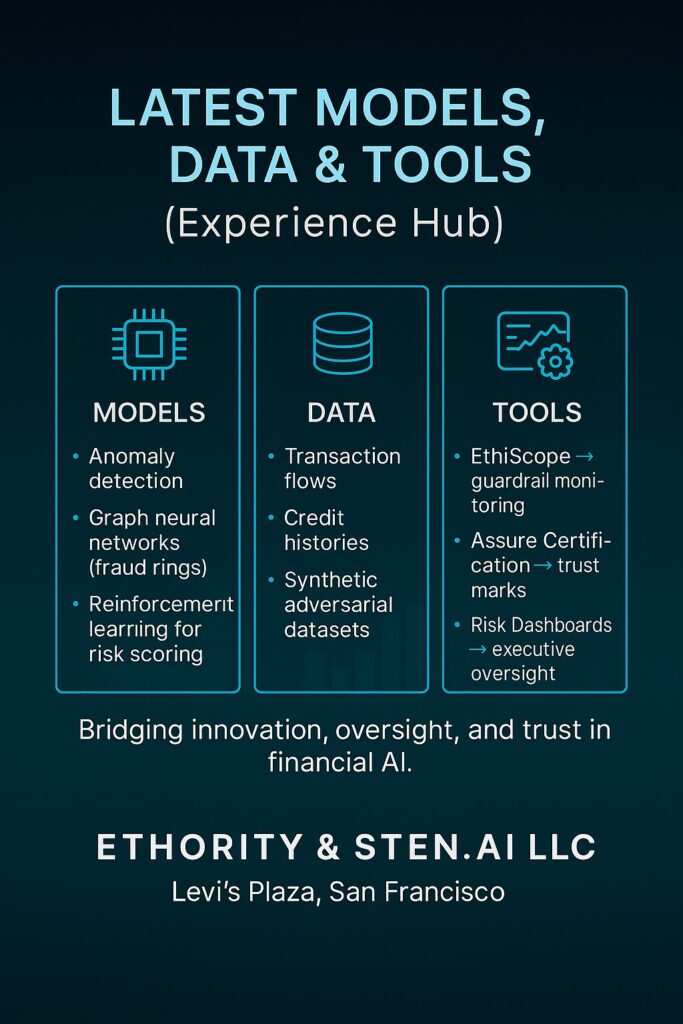

Latest Models, Data & Tools (Experience Hub)

Models: anomaly detection, graph neural networks (fraud rings), reinforcement learning for risk scoring.

Data: transaction flows, credit histories, synthetic adversarial datasets.

Tools:

EthiScope → guardrail monitoring platform.

Assure Certification → compliance trust marks.

Risk Dashboards → oversight for executives & regulators.

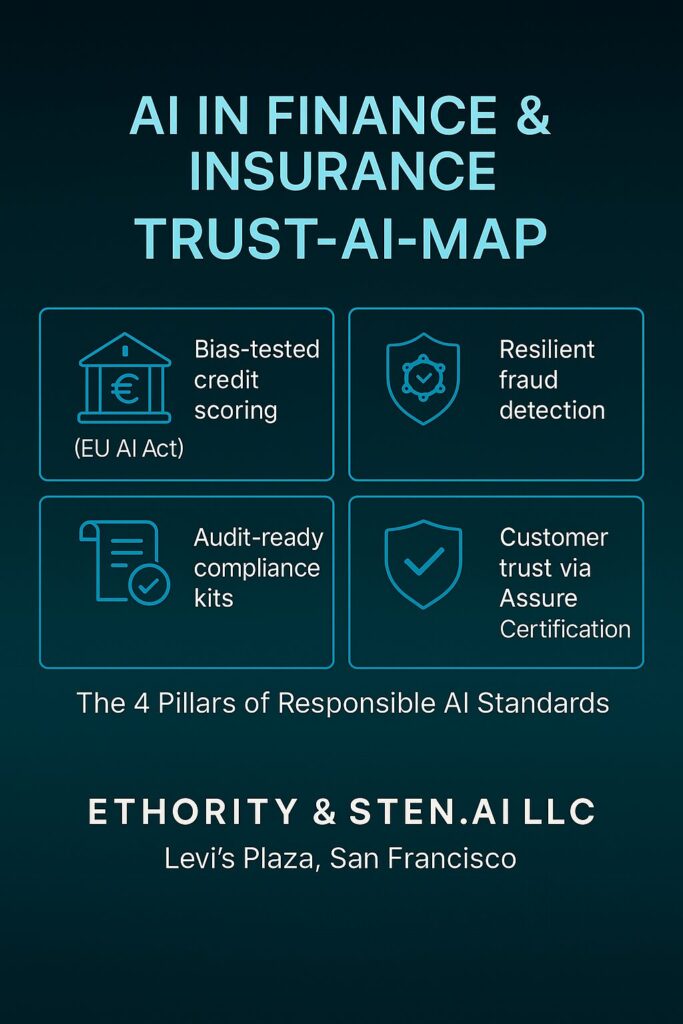

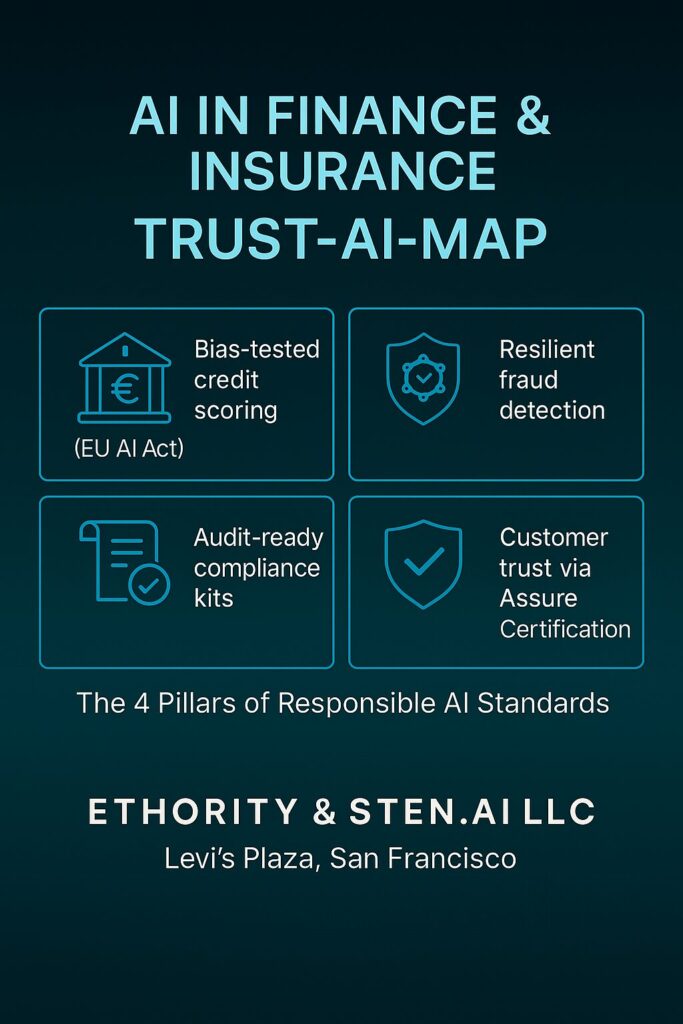

Outcomes for Finance Clients

Bias-tested scoring models aligned with EU AI Act.

Resilient fraud detection against drift & adversarial attacks.

Audit-ready evidence kits for regulators.

Trust signals through Assure Certification.

Why ETHORITY for Finance & Insurance?

End-to-End Lifecycle Coverage

From readiness checks and AI risk assessments to EthiScope monitoring and Assure Certification, ETHORITY secures the entire AI journey in finance.

Compliance by Design

Our frameworks embed EU AI Act, OECD finance principles, and IOSCO standards — ensuring audit-ready AI for credit scoring, fraud detection, and risk models.

Ethics at the Core

We engineer fairness, transparency, and explainability directly into financial AI systems — reducing bias, protecting consumers, and strengthening reputation.

Trust as Competitive Advantage

Through visible Assure Certification trust marks, financial institutions prove compliance to regulators, investors, and customers — turning trust into growth.

TrustAI Insights: Unveiling the Depths of Ethical AI

Dive deep into the dynamic realm of ethical AI with ETHORITY’s blog, TrustAI Insights. Stay ahead of the curve with our expert analyses, latest trends, and innovative breakthroughs. Our blog serves as a beacon for thought leadership, offering in-depth articles that explore the intricacies and evolving challenges of ethical AI. Experience the forefront of AI discourse and discover how ethical considerations are shaping the technology landscape. Read Our Latest Articles and become part of the conversation defining the future of AI.